Historically, traditional banks have led the cross-border payments market. But the traditional system has shortcomings, especially for consumers and small-medium businesses (those that usually have moved smaller amounts).

The main difficulties these stakeholders have experienced are:

- High costs.

- Too long transaction times.

- Lack of transparency.

- Hard understanding of the payment process.

According to a World Bank release, at the end of 2020 the global average cost of sending $200 is still very high (6.5%), more than double the Sustainable Development Goal target of 3%.

Not surprisingly, technology has made its triumphal entrance by improving the market imperfections, nourishing the need for trusted agents. At this point, fintech comes into play.

The Internet and the transition to online companies and businesses have accelerated the growth of cross-border payments over the years. For this reason, most financial institutions and fintech has had to adjust their business models and facilitate international transactions.

The traditional banking approach has faced challenges from rising trends. Fintech is transforming the current scene and creating a faster, easier and more transparent system of cross-border payments.

Regarding instant payments, user needs may be affected by an out-of-date bank service. In recent years, this gap has served as an incentive for improved services and technological advances.

In cross-border payments, fintech uses technology to reach new customers and providers. They also fight against the gap between obsolete models and new market demands.

Among the remarks of this article —focusing on how fintech applications are reinventing cross-border payments—we will explore different areas:

What are cross-border payments?

How do cross-border payments work?

Some statistics of the market of cross-border payments

How Fintech Is Reinventing Cross-Border Payments?

Banks Vs. Fintech: competition or ‘coompetition’?

How Reloadly is disrupting the cross-border payment space?

What are cross-border payments?

Cross-border payments are transactions that can be made between individuals, companies, banks or institutions. In these transactions, the payee and the receiver are in different countries and don’t necessarily share a border.

Electronic cross-border payments or money transfers are between online accounts or bank accounts registered in different countries.

How do cross-border payments work?

When a customer makes a purchase, there is a system that carries the money from the buyer’s bank to the vendor’s account. When we talk about cross-border payments, the process becomes a little more complicated.

Global transactions demand fees, a change of currency and managing an exchange rate. To deal with all these requirements, a banking system is in charge of moving money around the world.

In cross-border payments, banking institutions work with groups of domestic entities to make the transactions happen. This is how the process looks like:

- Across all the main cities of the world, each bank institution has a counterpart in another country. Funds will leave at first the buyer bank and will travel to the counterpart in order to get the remittance ready.

- The vendor/receiver bank will receive the funds. But these banks work with other banking locations to transfer the funds, which could involve even more than four banks.

- So many banking entities are working on a single transaction. This process can take a long time, and during this time all the banking locations are applying transaction taxes and fees.

It’s necessary for vendors who operate globally, to be able to accept cross-border payments with faster processing times.

Some statistics of the market of cross-border payments

The cross-border payments market is experiencing a boom. In the next few years, international B2B payments are going to have a great opportunity. Many markets are set to benefit from the simplification of the processes involved in cross-border payments thanks to fintech.

Let’s have a look at the most interesting statistics of cross-border payments:

A Juniper Research study found that the value of B2B cross-border payments will exceed $42.7 trillion in 2026, from $34 trillion in 2021. This research also identified that the eCommerce marketplaces will be the main contributor to this meteoric growth, which normally are native cross-border.

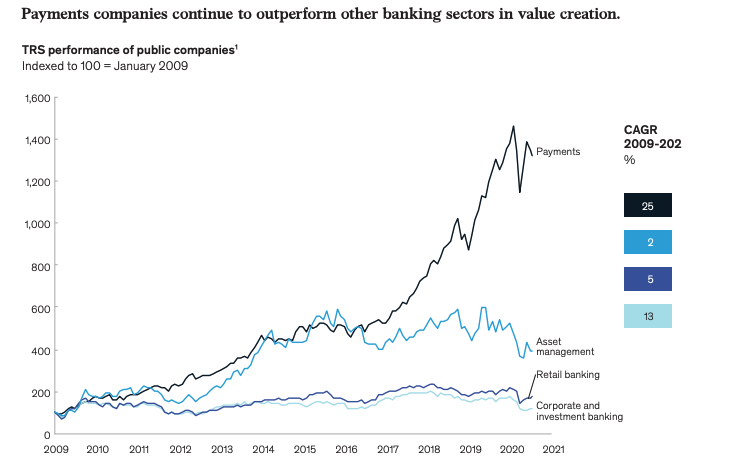

According to The 2020 McKinsey Global Payments Report, global revenues grew at nearly 5% in 2019, bringing total global payments revenue to nearly $2 trillion. Millions of businesses around the world are contributing to these $2 trillion. Fintech and payment companies are playing a more and more crucial role.

The Juniper research has identified that the current B2B cross-border payment market is quite fragmented. We already know the shortcuts: slow, expensive and difficult to track payments. The growing demand for an improved payment service must consider automatized processes, instant payment rails and virtual IBANs. Moreover, the acceptance of domestic payment options is crucial to success in the future.

Now, global cross-border payment flow is growing around 5% a year. But, what about the specific case of emerging markets? According to the World Bank, these markets have received over half-billion dollars in cross-border payments.

How Fintech Is Reinventing Cross-Border Payments?

Cross-border payments are the backbone of the economy and livelihood of the migrant population around the world. A huge amount of cross-border transactions are made everyday. For that reason, fintech has discovered a great opportunity here, creating new processes to optimize the transactions.

The shortcomings of traditional banking cross-border payments cannot be disregarded. They’re costly, cumbersome, often opaque and there is a lack of transparency. Furthermore, making international transactions used to be a slow process, causing delays and different fees and commissions.

Unquestionably, fintech has changed the game of international payments and remittances, solving most of the shortcomings. For this reason, consumers in every country are choosing these companies instead of more traditional entities.

Why are consumers choosing fintech over banks? Let’s see how fintech is changing the cross-border payment universe:

Quick transfers

Fintech technology provides cross-border transactions faster than traditional banks. These companies take care of design systems able to remove the extra time. Fintech also creates new rails that allow them to connect directly to major banks.

Definitely, new banking trends like open banking platforms are changing the universe of cross-border payments. We are closer and closer to sending money internationally as instantly as we make a local purchase.

Better exchange rates

By eliminating many costs associated with traditional cross-border payments, fintech is now able to provide better exchange rates to consumers. Moreover, fintech is providing fixed exchange rates, something crucial to guarantee the transparency of international transactions.

In contrast with traditional payments, modern cross-border transactions are cheaper or, in some cases, free of charge.

Flexible payment methods

Thanks to the emerging technologies implemented by fintech, customers can choose the desired payment method (traditional and non-traditional options).

An easier process

The current cross-border payment is marked by an easy access to transfer money anywhere and anytime, using a single device connected to the internet.

User experience

Fintech giants are concentrating more than traditional entities on the user experience in order to make complex processes smoother than ever. With this technology, customers now feel secure providing their banking information to foreign websites.

Marketing strategies

Technology can be used by fintech to collect data from the customers. This allows the company to know their buyer patterns, giving attractive offers to the clients.

Banks Vs. Fintech: competition or ‘coompetition’?

In recent years, fintech has gained specific weight in the matter of cheaper, faster and more flexible cross-border payments. This change has been carried out through two ways: non-traditional bank rails and modern tech solutions.

While major bank institutions are still dominating the international money market, fintech is more and more popular among small-medium businesses.

But the paradigm is more complex than a bank versus fintech competition. The money-transfer market is moving toward a ‘coompetition’ system: when traditional entities and modern technology companies are working together. Union means strength.

How Reloadly is disrupting the cross-border payment space?

On a mission to fuel cross-border mobile payments, Reloadly develops APIs with a technological structure specially designed for any level of programming, facilitating the integration of mobile businesses with operators easier than ever.

Since 2019, Reloadly has added +800 mobile operators in over 144 countries to its airtime API network. This has allowed the company to connect businesses to 5.22 billion mobile users.

Now Reloadly also allows businesses of every size to use its software to enable:

- Airtime top-ups

- Data bundles top-ups

- Digital goods as gift cards

- Bill payment aggregators

Final thoughts

The future of finance and cross-border payments is exciting. We are experiencing many changes that are about to reinvent cross-border payments as we know them. The trend is moving forward to the transformation of financial services to a more commonplace in our lives.

Technology has come with the promise to improve cross-border transactions by providing cheaper, faster and more transparent services. The trend is evolving to a ‘coompetition’ model between fintech and traditional bank institutions. The establishment of a unified cross-border payments system is not too far.